This blog was written by Excelera, a Shields company.

Two months ago, our blog discussed the potential impacts and areas of concern for health system specialty pharmacies and COVID. However, since it was still early in the pandemic, we didn’t have enough data points yet to really make sense of some of the effects and opportunities. Armed with additional data, we felt it made sense to re-examine some of the potential impacts of COVID by therapeutic class in our nationwide network of health systems.

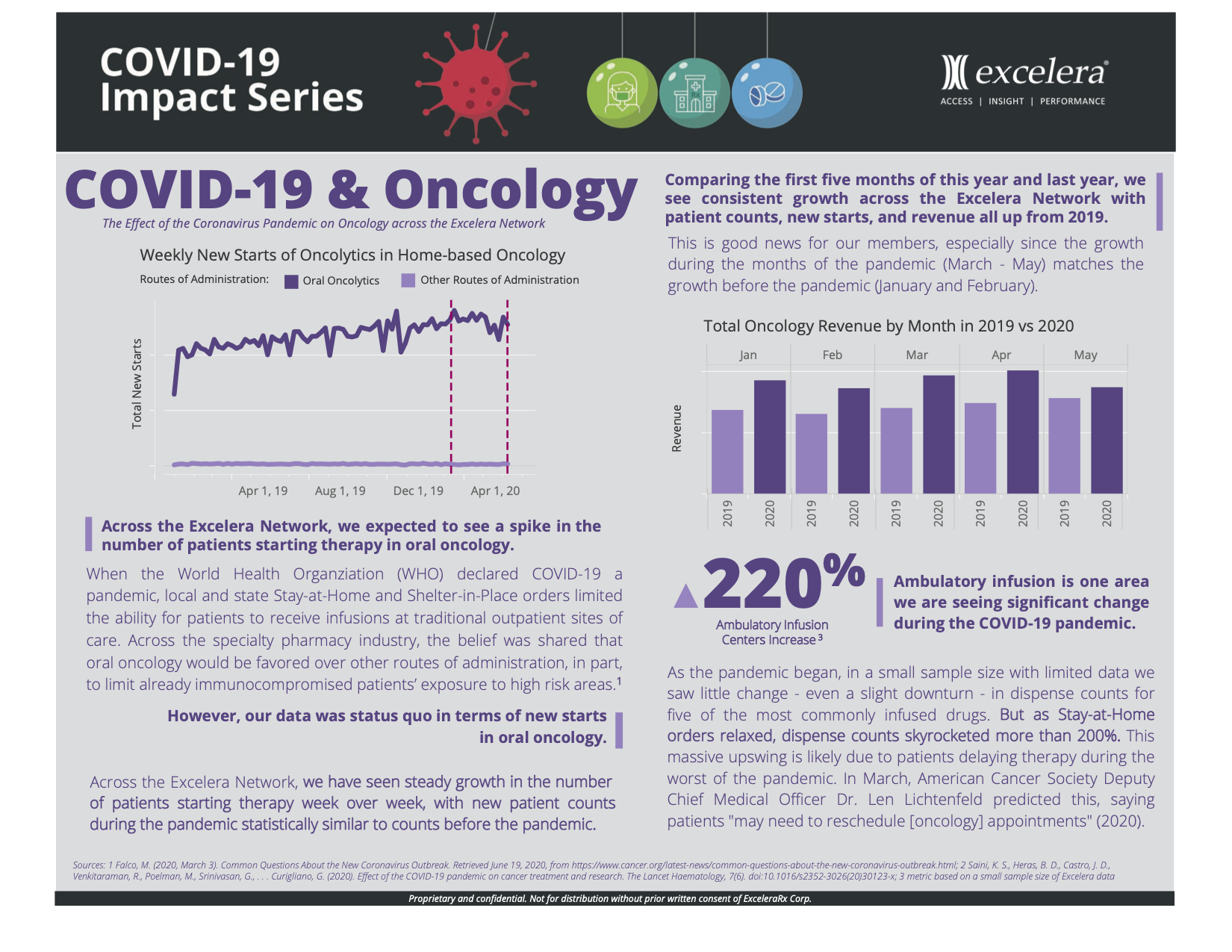

Previously, Sheena Babin, Director of Pharmacy Clinical Services and Business Development at Ochsner Health discussed opportunities for specialty pharmacy in oncology, including the potential for new outpatient oncology medications to hit the marketplace and lead to increased prescription volumes. Since the COVID-19 Pandemic began, eight new oncology drugs were commercially launched with open access and four have seen dispenses within the Excelera Network. However, our data shows no significant increase in at-home oncology medications regardless of route of administration or phase of their product lifecycle (e.g. newly launched or already in market). Refer to the line graph in the infographic below for a more in depth look. Comparing the first five months of this year to last year, we see consistent, yet statistically similar growth across the Excelera Network with patient counts, new starts, and revenue all up from 2019, and consistent between months before the pandemic and those during it.

Further, across the Excelera Network, we expected to see a spike in the number of patients starting therapy in oral oncology. However, our data was status quo in terms of new starts in at-home oncology despite hospitals clearing their census to make room for potential COVID patients which in some cases, such as infusion therapy, allowed patients who qualified to move to a different site of care such as home infusion. Our data did show that ambulatory infusion is one area we are seeing significant change during the COVID-19 pandemic, as demand for infusion was pent up during the worst of the pandemic. As stay at home orders relaxed, we saw a spike of roughly 220% in ambulatory infusions from the typical averages before the pandemic. This is likely due in part to clinics and patients wanting to limit interaction in clinical settings. For a more detailed description, see the infographic below.