Stability begets stagnation

COVID-19 has left many companies feeling unstable this year, which has companies seeking stability through the deferral of employee benefit decisions to 2021 or beyond. For example, many companies who were looking around for a new Pharmacy Benefit Manager (PBM) partner before COVID-19, have favored stability through the continued use of the three largest PBMs despite potential philosophical differences. We believe this will contribute to a widening gap between the smaller, newer PBMs and the larger PBMs, slow the innovation we were seeing and continue to reward perverse incentives that have shed a negative spotlight on PBMs in recent years.

The three largest PBMs, CVS Health’s Caremark PBM, Cigna’s Express Script PBM, and United Health’s Optum PBM, controlled over 75% of the market in 2018 ¹. When you consider that the top six PBMs manage 95% of prescription claims in the US (plus Humana, MedImpact and Prime Therapeutics), the time is ripe for newer and nimbler PBMs to enter this market.

Price alone is not a fair fight

While the well-known narrative is that size and scale allow the big PBMs to negotiate deeper discounts and larger rebates from pharma that they in turn pass along to plan sponsors, a survey of PBM executives conducted by the Pew Charitable Trust² highlights that a hefty sum, or $8.1B, remained with the PBMs.

To keep that “rebate bucket” full, and their share of it high, many PBMs build their formularies around the medications carrying the largest rebates. This tends to drive up overall costs for plan sponsors and creates an imbalance when the sum of money coming back to the PBM (and shared in portion with the plan sponsor), is seemingly valued more than patient outcomes. Especially when there are equally efficacious medications that can be obtained at a lower net cost to the health plan being pushed down on the formulary in favor of more expensive medications with high rebates. Plan sponsors are spending more on the front end, in hopes of getting rebates on the back end, which is flawed thinking: plan sponsors should be focused on spending less overall.

But price alone is not a fair fight. Smaller PBMs can and need to differentiate themselves from their peers:

- shifting their focus to niche business and addressing the needs of specific market segments: workers compensation, specific disease states, or building clinically driven formularies not focused on rebates.

- driving innovation in an industry rife with perverse incentives and lack of transparency.

Focus on better outcomes, patient experience

In these uncertain times, when innovation and forward thinking are truly necessary, smaller PBMs can show real advantages to plan sponsors of taking a chance now rather than defaulting to a large PBM in the interest of short-term stability.

Excelera’s Pharmacy Benefit Solution is a smaller, niche offering that aligns with this thinking. By acknowledging that we cannot compete on price alone and aren’t interested in fostering large rebates simply through perverse incentives, we are free to focus on innovative solutions to what truly matters to health systems: better outcomes and patient experience. How does Excelera accomplish this?

- Excelera works with health system partners to design custom formularies that meet their diverse patient need.

- Excelera passes all rebates achieved back to the health system.

- Excelera ensures the most efficacious medications are

- available to members at the lowest net cost.

The result: patient outcomes and patient experience are pushed to the forefront rather than rebates.

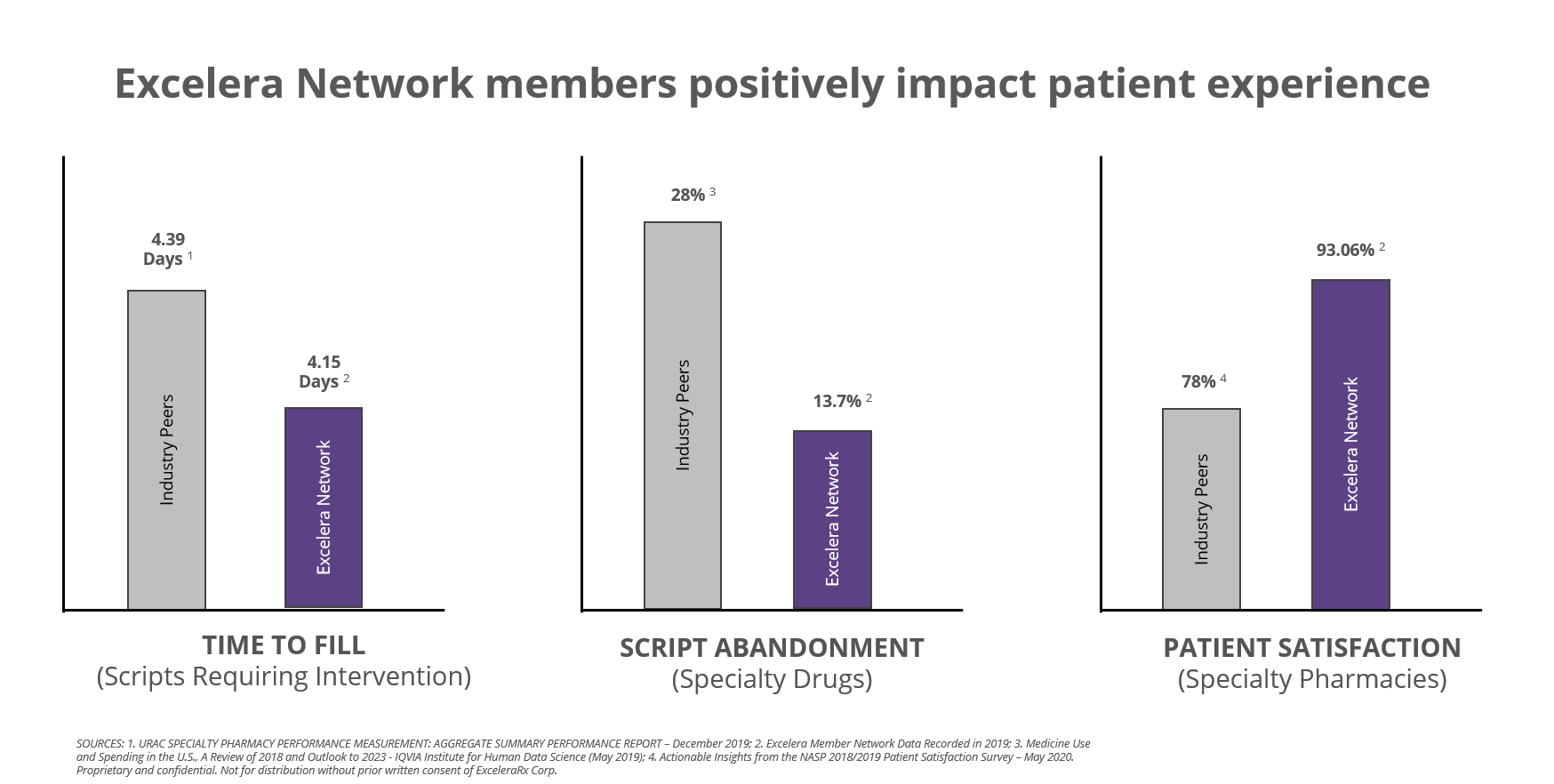

Excelera Network outperforms industry peers

Additionally, Excelera’s Pharmacy Benefit Solution is not averse to enabling the health systems specialty, retail, and ambulatory pharmacies as the central hub of their network. Data shows patients serviced by Excelera health system specialty pharmacies positively impact patient experience and outperform industry peers in key indicators as shown below.

In uncertain times, finding your niche may be the best employee benefit strategy. If your goals include ensuring stability for employees, placing their care at the center of their employee benefit should be paramount. If ensuring business longevity is a goal, keeping patients and their prescriptions within the health system owned pharmacies should be paramount. If 2020 has taught us anything it’s that outcomes and innovation should drive decisions, not complacency.

Sources: ¹ Drug Channels 2018, ² Pew Charitable Trust 2016